Student loans can effect it BUT consider the following. How to Use Student Loans to Rent an Apartment.

Buying A House With Student Loan Debt Lendedu Real Estate Investing Real Estate Estate Agent

Buying A House With Student Loan Debt Lendedu Real Estate Investing Real Estate Estate Agent

If you are trying to move out on your own and rent an apartment keep in mind that your student loans and your repayment history will impact your credit.

Do student loans affect getting an apartment. Student debt is keeping homeownership out of reach for many millennials. A school might issue you a refund if you borrowed above the cost of education to fund meals transportation or off-campus housing. If your credit is bad try getting a roommate with better credit and also cut the cost of rent by splitting payments.

But while student loan payments can make it harder to save for a down payment on a home they shouldnt stop you from pursuing your dream of homeownership. Each state and Medicaid program has unique rules for asset limits. Most landlords and rental companies have strict income requirements.

Apply for a loan that will. If you can save a 20 or more down payment your student loans are far less likely to affect your loan process. As a cosigner on a student loan you are equally responsible for repaying a student loan as the loans primary borrower.

Missing a student loan payment can lower your credit. Some 45 million people in the United States carry student debt. Most not all rentals check credit.

Student Loans and Renting an Apartment Your monthly student loan payments as well as your balance are going to show up on your credit report. The hope is that you wont have to repay the. We have highlighted some things below that are affected by your student loans for your consideration.

The average first-time home buyer in 2018 had 30000 in student loan debt NAR reports. If thats the case its important to know that there are ways to rent an apartment with your student loan funds. Student loan debt has become a major barrier to home ownership in America.

Any student loan refunds from your college could affect Medicaid eligibility if the money held in your bank account exceeds the asset limits. Student loans might be the only source of money you have access to. As a student you might have a small or even nonexistent income.

Student loan debt may increase your debt-to-income ratio affecting your ability to qualify for a mortgage or the rate you are able to get. The analysis found that 23 percent of college graduates without student debt can save enough for a down payment within the next five years compared to just 12 percent of graduates who are paying back student loans. Any time you are extended a new line of credit your credit is affected.

It also determines which dreams youre able to pursue and which ones will become a distant memory. I am trying to get a private student loan but my parents refuse to cosign because they fear cosigning for my student loan will affect their credit score thus lowering their chances of getting a mortgage. So will your minimum payments and balances on your other debts if the creditor reports to the credit bureaus.

College loans dont just pay for tuition and books. This is so important because this will be my final year of college. So if you are not in good standing with your loan payments it certainly would be a factor in renting.

Your income and job history. The size of your available down payment will affect your front-end ratio the more you borrow the higher the PITI. Cosigning on a student loan qualifies as being extended a new line of credit so being a cosigner on a student loan does in fact impact your credit.

Keep reading to learn how you can manage student loan debt and still get approved for a mortgage. Depending upon the type of loan the loan amount will either be disbursed to you directly or it will go to your college from where you will receive the funds after the tuition costs have been subtracted. They also help to cover living expenses associated with college including renting an apartment.

Student loan debt affects more than your financial independence and your standard of living. The steps to secure a student loan and use it to lease an apartment especially for an immigrant student are given below.

Qualifying For A Mortgage With Student Loan Debt Student Loan Hero

Qualifying For A Mortgage With Student Loan Debt Student Loan Hero

How To Buy A House With Student Loan Debt Rocket Mortgage

How To Buy A House With Student Loan Debt Rocket Mortgage

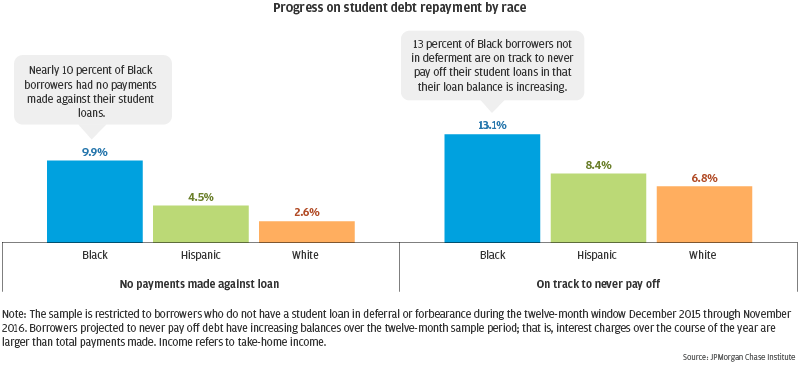

Student Loan Debt Who Is Paying It Down

Student Loan Debt Who Is Paying It Down

Bad Credit Student Loans Federal Private Loan Options

Bad Credit Student Loans Federal Private Loan Options

Obtaining Loan For College These Days Appears All But Inescapable For Everybody But The Wealth Student Loan Repayment Student Loan Repayment Plan Student Loans

Obtaining Loan For College These Days Appears All But Inescapable For Everybody But The Wealth Student Loan Repayment Student Loan Repayment Plan Student Loans

Saddled With Student Loan Debt There S Still Hope For Homebuying

Saddled With Student Loan Debt There S Still Hope For Homebuying

Pin On College And Dorm Room Tips

Pin On College And Dorm Room Tips

Bar Chart Showing The Distribution Of Student Loan Borrowers By Balance Student Loan Debt Student Loans Refinancing Student Loans

Bar Chart Showing The Distribution Of Student Loan Borrowers By Balance Student Loan Debt Student Loans Refinancing Student Loans

How Paying Off Student Loan Debt Affects Your Credit Score

How Paying Off Student Loan Debt Affects Your Credit Score

Buying A House With Student Loan Debt Here S How To Do It Student Loan Hero

Buying A House With Student Loan Debt Here S How To Do It Student Loan Hero

Busting Myths On Student Loan Forgiveness Debate Student Loan Hero

Busting Myths On Student Loan Forgiveness Debate Student Loan Hero

How Do Student Loans Affect Your Credit Score Sofi

How Do Student Loans Affect Your Credit Score Sofi

Do Student Loans Affect Your Credit Credit Com

New York Student Loans Debt Statistics Student Loan Hero

New York Student Loans Debt Statistics Student Loan Hero

Busting Myths On Student Loan Forgiveness Debate Student Loan Hero

Busting Myths On Student Loan Forgiveness Debate Student Loan Hero

How To Use Student Loans For Living Expenses Credible

How To Use Student Loans For Living Expenses Credible

How Paying Off Your Student Loans Affects Your Credit Score Student Loan Hero

How Paying Off Your Student Loans Affects Your Credit Score Student Loan Hero

How Your Credit Score Can Affect Your Rental Apartment Application Jna Credit Score Finance Blog Being A Landlord

How Your Credit Score Can Affect Your Rental Apartment Application Jna Credit Score Finance Blog Being A Landlord

How Do Your Student Loans Affect Your Credit Score Pinned By Student Loan Cons Pay Off Debt Stu Paying Off Credit Cards Student Loan Repayment Loan Payoff

How Do Your Student Loans Affect Your Credit Score Pinned By Student Loan Cons Pay Off Debt Stu Paying Off Credit Cards Student Loan Repayment Loan Payoff

0 comments:

Post a Comment